Search This Blog

Welcome to Your Ultimate Resource for Cross-Border and U.S International Tax Compliance! Navigating the complex world of taxes can be overwhelming, especially with cross-border, foreign compliance, and US international tax issues. Whether you are an individual or a small business owner, my blog is here to take the headache out of searching for answers. Drop a word, suggest a topic, share your thoughts, questions, and experiences. SPREAD THE BUZZ AND LET OTHERS KNOW ABOUT THIS VALUABLE RESOURCE!

Posts

Showing posts from January, 2014

Do You Have An "ID"entity?---Protect It From Theft!!

- Get link

- X

- Other Apps

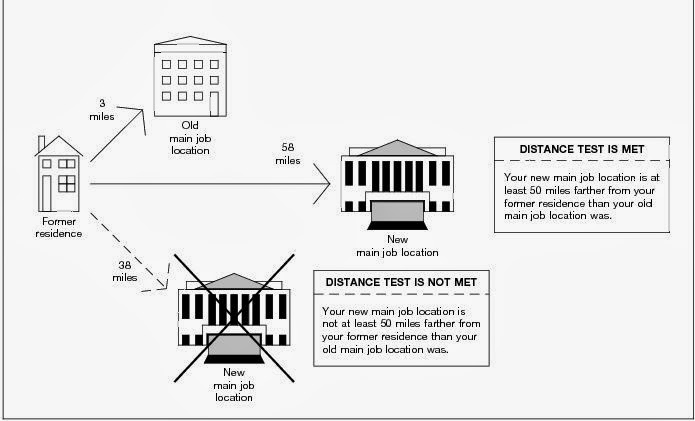

Moving On In Life? How That Can Be Tax Deductible!!

- Get link

- X

- Other Apps

Begin With The End In Mind: End Of Life Planning

- Get link

- X

- Other Apps

The Transfer Tax That Skips Generations: Otherwise known as the GSTT!

- Get link

- X

- Other Apps

Why Taxes Shouldn't Be DIY Projects! Hire an Enrolled Agent!

- Get link

- X

- Other Apps

Search By Category

Search By Category

- 130843-131

- 2009 Offshore Voluntary Disclosure Program1

- 2011 Offshore Voluntary Disclosure Initiative1

- 20131

- 2015 Tax Law Changes1

- 2016 form 11201

- 20171

- 2017 Tax Season1

- 2018 Tax Changes1

- 2020 Planning Ahead1

- 2020 Tax Season2

- 3.8%2

- 401(k)6

- 401(k) for Small Business1

- 401k1

- 403 (b)1

- 4506-T1

- 457 (b)1

- 501 (c) (3)1

- 529 Plan2

- 6038D1

- 70 1/2 years old1

- 96441

- AAA1

- ACA1

- Accelerated Death Benefits1

- Accidental Americans2

- Accounting Habits1

- Advance Health Care Directives1

- Affordable Care Act1

- Age 59 1/21

- Agrawal DC WI 12/9/20191

- Airbnb1

- Alien1

- Alimony; Divorce Payments1

- American Abroad2

- Announcement 2012-451

- Annual Exclusion1

- Annuities2

- April 182

- Armed Forces Move1

- Back Taxes1

- Bank Secrecy Act2

- Bankruptcy1

- Bankruptcy Discharge1

- beneficial ownership1

- Beneficiary2

- Bequest2

- Big Ticket Items1

- Bitcoin2

- Bitcoin cash2

- Bittner1

- Black Friday1

- blockchain2

- Bonafide Residence Test1

- Bonus1

- Branch Office In US1

- BSA E-Filing System1

- BSA E-Filing System.1

- Burial Services1

- Business6

- Business Owners2

- Buyer Beware1

- Campus Health Insurance1

- Canada1

- Canadians1

- Cancellation of Debt1

- Capital Gains1

- Capital Loss Harvesting1

- Cash Flow1

- Casualty Losses1

- Catch Up Contributions1

- Categories of Filers1

- Certain Citizens1

- Certification1

- Change of Address1

- Changes to Itemized Deduction2

- Chapter 111

- Chapter 31

- Chapter 41

- Chapter 71

- Chapter 91

- Charitable Contributions2

- Child Care1

- Child Care Costs1

- Child Support1

- Children1

- Children's Savings1

- Choosing between an S Corp Vs an LLC2

- Citizen Based Taxation1

- Citizenship Based Taxation1

- Claim Exclusion1

- Closely Held.1

- Closer Connection2

- College Expenses2

- College Savings3

- College tax Credits1

- Commingling Expenses1

- Common Law Rules1

- Computer1

- Conference Agreement1

- Contributions1

- Coronavirus1

- Corporate Transparency Act1

- Corporations2

- Court Case3

- Court Case2

- Court Case Versus FATCA.1

- Covered Expatriate7

- Covid-191

- Credit Card Debt1

- Credit cards2

- Credit Report1

- cross border inheritance/ gift1

- cross border tax1

- Crunching Numbers1

- Cryptocurrency2

- Currencies2

- Currency1

- Custodial Accounts1

- Data Plans1

- Data Safety1

- Data Security1

- Deadline2

- Death Benefits1

- Debt1

- Debts1

- Decedent1

- Deducted1

- Deduction1

- Delinquent FBARs6

- Demystified2

- Denial of Passport1

- Department of Labor1

- Dependent Care1

- dependents on social security1

- Designation Form1

- Detroit1

- Disabilities1

- Disaster Loan1

- Distributions1

- divorce1

- Divorce Decree1

- Documents1

- Documents for Tax Filing1

- Doing Business In The US1

- DOL1

- dol.gov1

- DOMA1

- Donations2

- Draft Form 89601

- dual status returns1

- Due Date1

- Due Diligence1

- E-Commerce1

- EA2

- Ebay1

- ECI1

- Effectively Connected Income5

- Elder Law1

- Eligibility; Simple Risk; OVDP3

- Email Encryption1

- Emergency Check1

- Employee5

- Employer Contributions1

- Employer Retirement Plans3

- End Of Life Planning1

- Energy Efficient Home1

- Enrolled Agent14

- Enrolled Agents1

- Entity Filing 89381

- Entity in the US1

- Entity Selection.2

- ERISA1

- Estate Planning5

- Estates2

- Etsy1

- Exclusions1

- Exemptions from GSTT1

- Exit Planning1

- Exit Tax2

- Expat9

- expat individual2

- Expatriate6

- Expatriate Taxation6

- Expatriation7

- Expenses & Deductions1

- Expire1

- Expired ITINs2

- Extension2

- Extension of Time To File1

- Extensions1

- F-1 Visa1

- Failure To File Penalty3

- Failure To Pay Penalty1

- FAQ 81

- Farhy2

- FATCA26

- FATCA Penalties2

- FBAR31

- FBAR Court Case2

- FBAR Deadlines; new FBAR Deadlines3

- FBAR for Children1

- FBAR Penalties5

- FBAR Rules1

- FDAP Income3

- FEIE1

- Fellowships1

- Filing1

- Filing Jointly1

- Filing My Taxes2

- Filing Status1

- Filing Taxes1

- Final Regulations2

- Financial accounts1

- FinCEN Form 11410

- FinCEN Form 114.2

- FinCEN form 114a1

- FIRPTA1

- Flexible Spending Account1

- Flow-Through Income1

- Foreign5

- Foreign Account Reporting for Corporations2

- Foreign Accounts8

- Foreign Annuities1

- Foreign Assets1

- Foreign Bank3

- Foreign Bank Account Regulations11

- Foreign Bank accounts2

- Foreign Contributions1

- Foreign Corporations Doing Business in the US1

- Foreign Corporations.1

- Foreign Country1

- Foreign Earned Income Exclusion9

- Foreign Executives1

- Foreign Fianancial Account2

- Foreign Financial Account3

- Foreign Financial Institution1

- Foreign Freelance Income1

- Foreign Gifts2

- Foreign Grantor Trust1

- Foreign Housing Exclusion1

- Foreign Income4

- Foreign Mutual Funds1

- Foreign Nongrantor trust1

- Foreign Partner1

- Foreign Partner Reporting1

- Foreign Partnerships1

- Foreign Pensions3

- Foreign persons2

- Foreign Real Estate2

- Foreign Retirement1

- Foreign Social Security2

- Foreign Student1

- Foreign Tax Credit9

- Foreign Trust1

- Foreign-Owned US Corporations1

- Form 10403

- Form 1040NR1

- Form 1099-MISC2

- Form 11161

- Form 140391

- Form 24411

- Form 25551

- Form 35206

- Form 3520-A2

- Form 39031

- Form 433 series1

- Form 48681

- Form 53291

- Form 54714

- Form 54722

- Form 7092

- Form 86151

- Form 86211

- Form 88141

- Form 88221

- Form 88331

- Form 88801

- Form 89191

- Form 893813

- Form 89601

- Form 9401

- Form 9411

- Form 94651

- Form SS-81

- Form W-72

- Form W-8 BEN; Individuals1

- Form W-8BEN1

- Form W41

- France1

- Freelance Income1

- Freshman 151

- From 54711

- FSA2

- FSLA1

- FTC2

- FUTA1

- Future Interests1

- Generation Skipping Transfer Tax1

- Generations1

- Getting Ready1

- Gift of Property1

- Gift Tax2

- Gift Tax Returns1

- Gifts4

- Gifts from Foreign Persons4

- Gifts from Foreign sources3

- Gig Economy1

- Good Habits1

- Grantor1

- Grants1

- Green Card Holders3

- Greencard2

- GST1

- GSTT1

- Health1

- Health Coverage1

- Health Insurance2

- Hillary Clinton1

- Hire an Enrolled Agent3

- Home1

- Home Mortgage Interest2

- Home Office1

- Home Office Deduction1

- Home Ownership1

- Homeowners1

- Household Employee1

- Housing1

- How long do I keep records?1

- How to Pick a Preparer1

- HSA1

- ID Theft1

- Identity1

- Identity Theft3

- Identity Thief1

- IGA1

- Incorrect Information1

- Incorrect Refund1

- Independent Contractor4

- India2

- Individual52

- Individual Retirement Accounts8

- Individual Tax Identification Numbers1

- Individual Taxpayer Identification Number4

- Individual.1

- Individuals23

- Inheritance from Foreign Persons2

- Inheritances2

- Inherited IRAs2

- Injured Spouse1

- Innocent Spouse1

- Installments1

- Insurance Marketplace1

- Insuranse Coverage1

- Internal Revenue Service2

- Internal Revenue Service Bankruptcy1

- International1

- international tax1

- International tax planning4

- international tax reporting1

- Investing in the US1

- Investments in Foreign Corporations2

- Investments In Foreign Pensions & Annuities2

- IRA7

- IRA Beneficiaries1

- IRA Contribution Limits1

- IRA with Basis1

- IRAs1

- IRC 14111

- IRC 2151

- IRC 9111

- IRS2

- irs.gov1

- Itemize deductions2

- Itemized deduction1

- Itemized Deductions3

- ITIN5

- Joint Accounts1

- Joint Return1

- Journal Of Accountancy1

- July 15th1

- kiddie Accounts1

- Kiddie Tax1

- Kids2

- Last Minute Filer1

- Late Filing1

- Late Returns1

- Latest Changes1

- Liens1

- Life Insurance1

- Life Insurance Proceeds1

- Limited Liability Company1

- Living Abroad1

- Loans1

- Lyft1

- MAGI Thresholds1

- Manasa Nadig15

- Marital Status1

- Mark-to-Market1

- Marketplace1

- Marriage1

- Married1

- Married Filing Status1

- May 151

- Meal Plan1

- Medical Expense Deduction2

- Medical Expenses1

- Medicare Tax3

- Memorial Services1

- MIP1

- Missing W21

- Mistakes Expat Make3

- Moore2

- Moving Expense1

- moving expenses2

- Municipalities1

- Mutual funds1

- myRA1

- NAEA1

- Nanny Tax1

- National Taxpayer Advocate Service1

- Net Income1

- Net Investment Income3

- Net Investment Income Tax6

- New Deadline1

- New Policy1

- New Regulations2

- Newly-Weds1

- NIIT4

- Non Profit Organizations1

- Non-Compliance with FBAR Requirements7

- Non-Immigrant Work Visa1

- Non-Profit1

- Non-Resident1

- Non-resident alien2

- Non-Resident Individuals2

- Non-Resident Spouse1

- Non-Resident U.S. Citizens; Compliance Risk1

- Non-Resident US Taxpayers1

- non-US Citizen1

- Non-Willful2

- Nonresident American1

- Notice to Employees1

- NRA Holding US Real Estate1

- Obamacare3

- Obamacare Tax3

- Obituaries1

- OECD1

- Offer In Compromise1

- Offshore Mutual funds1

- Offshore Voluntary Disclosure Initiative1

- Old ITINs2

- One Rollover Per Year1

- Online Payment Agreement Tool1

- Online Sales1

- OPT1

- Ordinary and Necessary Business Expenses1

- OVDI1

- OVDP Closed1

- OVDP process3

- Pandemic1

- Partnerships2

- Passive Foreign Investment Companies1

- Passive Income1

- Passport2

- PATH Act2

- Payment Agreement1

- Payroll3

- Payroll Mistakes2

- Payroll Tax1

- Payroll Taxes1

- Penalties3

- Penalty3

- Pensions2

- Perform Services1

- Permanent Residents1

- Personal Information1

- PFIC1

- PFICs1

- Physical Presence Test2

- Plan Contributions1

- Planning1

- Planning Your Withholding1

- POD Trust1

- Pointers1

- post-tax contributions1

- Pre-immigration tax planning2

- pre-tax contributions1

- Preparer1

- Preserve Tax-Exempt Status1

- Printer1

- Procedure1

- Procrastinators1

- Property Taxes1

- Proposed Regulations1

- Protecting Americans from Tax Hikes Act2

- Protecting your Identity1

- Protection from Identity Theft2

- Pub 15; sba.gov1

- Pub 5902

- Pub 9291

- Publication 5021

- Publication 5211

- Publication 541

- Publication 950;1

- QBI1

- QCD1

- QEF1

- QLACs1

- QSBS1

- Qualified Business Deduction1

- Qualified Electing Fund1

- Qualified Longevity Annuity Contracts1

- Rainy Day1

- Real Estate1

- Real Estate Investment in the US1

- Reasonable Cause1

- Record Keeping3

- Refresher1

- Refund1

- Refunds in Limbo1

- Regular Method1

- REIT1

- Relief1

- Relinquishment1

- Renounce Green Card2

- Rental Income2

- Renunciation1

- repatriation1

- Repatriation Tax2

- Reporting Foreign Bank accounts1

- Required Minimum Distributions4

- Researcher1

- Residency1

- Residency Based Taxation1

- Resident1

- Resident Alien1

- Residential Energy Efficiency Credits1

- Retire Abroad3

- Retirees Move1

- Retirement1

- Retirement accounts8

- Retirement Planning7

- Retirement Savings4

- Retirement Savings Credit1

- Revocation of Passport1

- Revoke Exclusion1

- RMD2

- RMDs1

- Rollover2

- Rollovers1

- Room & Board1

- ROTC1

- Roth2

- Roth 401(k)5

- Roth Conversions2

- Roth IRA8

- Roth IRA Contribution Limits1

- Roth IRA's1

- S CORPS3

- Sales Tax2

- SALT1

- Saving for Kids1

- Savings Clause1

- SBE1

- Schedule A5

- Schedule C4

- Schedule E2

- Schedule F1

- Schedule H1

- Scholarships1

- Section 199A1

- Section 501(c)(3)1

- Secure Act2

- Secure Portal1

- Self-Employment2

- Self-Employment Tax1

- Selling To US Customers1

- Senior Tax Planning1

- Sensitive Information1

- Seriously Delinquent Tax Debts1

- Setup Payroll; Payroll Penalties2

- Shared Economy1

- Signature authority1

- Simplified Option1

- Small business5

- Small Business Owners6

- Small Business Owners; Cyber; Cyber-Security; Cyber Protection; Network Protection;1

- Smart Giving1

- Smart Phones1

- SME1

- Social Security4

- Social Security Benefits1

- Social Security Benefits While Abroad5

- Social Security Numbers5

- Social Security Tax1

- Sole Proprietor2

- Sooner the Better1

- Special Needs1

- Specified Domestic Entity1

- Specified foreign Asset1

- Specified Foreign Financial Assets1

- Specified Individuals3

- Spouse3

- SS-51

- SSA2

- SSI1

- SSN3

- Standard Deduction1

- Start-Up1

- Start-Up Expenses1

- State Payroll1

- State Residency1

- state tax1

- Stimulus Check1

- Streamlined Compliance Procedure5

- Stretch IRA1

- Student3

- Student Loans3

- Student Loans Paid Off1

- Students1

- Substantial Presence2

- Summer Camp1

- Summer Jobs1

- Summer Jobs Taxes1

- Surrender1

- Survivors Move1

- SUTA1

- tax1

- Tax Blog1

- Tax Consequences1

- Tax Court2

- Tax Cuts and Jobs Act2

- Tax Deadline3

- tax due1

- Tax Due Date1

- Tax Exempt1

- Tax Extenders1

- Tax Extenders Bill1

- Tax Loss Harvesting1

- tax papers1

- Tax Planning3

- Tax Preparation1

- Tax Preparer1

- Tax Professional1

- Tax Reform1

- Tax Reform And Jobs Act1

- Tax Season2

- Tax Straggler1

- tax time1

- Tax Treaty10

- Tax Withholding1

- Tax-Exempt Organizations1

- Taxable1

- Taxes4

- Taxpayer Abroad1

- TCJA1

- TD F 90-22.11

- TDF90-22.11

- Textbooks1

- TFRP1

- Thresholds1

- Tie-Breaker Rules1

- Tip Income1

- Tips1

- Tips for Newly Weds1

- Tips on Charities1

- Totalization Agreement2

- Totten Trust1

- Track my refund1

- Traditional 401(k)2

- Traditional IRA6

- Traditional Vs Roth IRA3

- Travel1

- Treaty Interpretation1

- Treaty Provisions2

- Trump Tax Plan1

- Trust Fund Recovery Penalty1

- Trustee1

- Trusts3

- Tuition & Fees Deduction1

- UAE1

- Uber1

- UGMA1

- Unemployment1

- US citizen Abroad6

- US Citizens2

- US Citizens Overseas7

- US income1

- US Person1

- US Source Income2

- US-Canada1

- USPS1

- Victim1

- Virtual Currency2

- Visa2

- visa holders1

- Voluntary Classification Settlement Program.1

- Voluntary Disclosure1

- Volunteer Miles2

- Volunteer Time2

- Volunteering2

- W21

- Wages1

- Waiver1

- What is Chapter 9 Bankruptcy?1

- When Should I File My Taxes1

- Where to look for W2?1

- Where's My Refund? IRS1

- Willful Non-Compliance2

- Withholding1

- Withholding Calculator1

- Withholding Tax1

- www.slugbooks.com1

- Year end Tax Planning Tips3

- Your Payments While You Are Outside the United States1